TakeProfitTrader is a futures proprietary trading firm offering traders the opportunity to access funded accounts without risking personal capital. Based in Orlando, Florida, this prop firm has gained significant attention for its trader-friendly features and competitive profit-sharing model. In this TakeProfitTrader review 2025, we’ll examine everything from account options and trading platforms to profit targets and withdrawal processes.

TakeProfitTrader Overview: What Sets This Prop Firm Apart

TakeProfitTrader distinguishes itself in the competitive prop trading landscape through several key features. The firm offers funded futures trading accounts with capital ranging from $25,000 to $150,000, allowing traders to keep 90% of profits. With over 800 Trustpilot reviews and an impressive 4.3/5 star rating, TakeProfitTrader has established itself as a reputable option for futures traders.

What makes TakeProfitTrader particularly attractive to traders is the combination of reasonable profit targets, instant withdrawals, and PRO account resets. Unlike many competitors, TakeProfitTrader allows traders to request payouts from the first day of trading in PRO accounts, with an efficient withdrawal process.

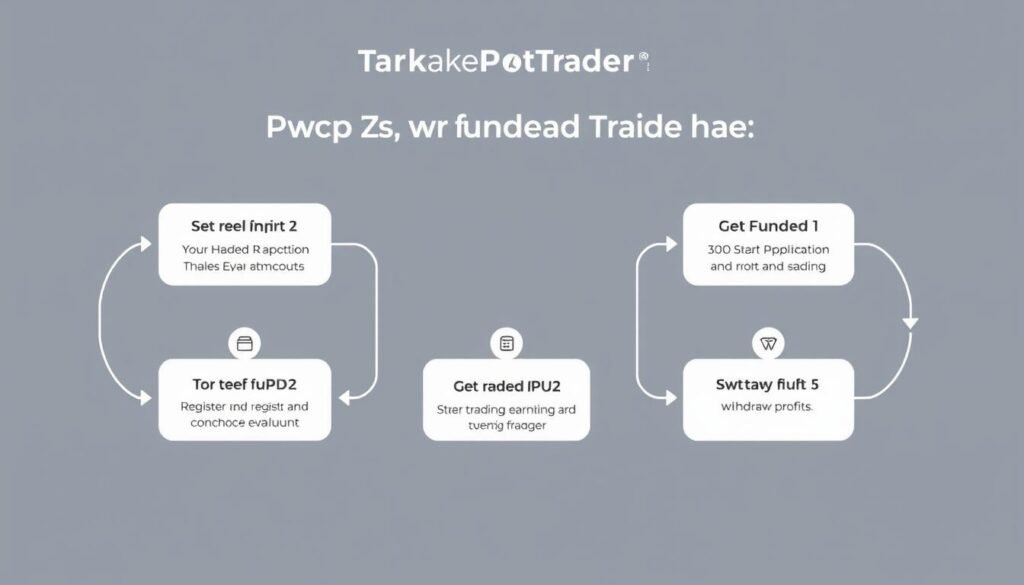

Becoming a Funded Trader with TakeProfitTrader

TakeProfitTrader has streamlined the process for attaining funding. Traders simply need to select a funded account that meets their needs and demonstrate they have the requisite trading abilities. Those who succeed will quickly be able to start trading with real capital and retain a significant portion of the profits they generate.

TakeProfitTrader Account Types: Test, PRO, and PRO+

TakeProfitTrader offers three main account types, each designed for different stages of your trading journey. Understanding the differences between these accounts is crucial for maximizing your success with the platform.

| Feature | Test Account | PRO Account | PRO+ Account |

| Purpose | Evaluation phase | Funded trading | Advanced funded trading |

| Profit Split | N/A | 90% trader / 10% firm | 90% trader / 10% firm |

| Daily Loss Limit | Yes | Yes | No |

| Account Resets | Limited | Up to 3 times | Up to 3 times |

| 50 Executions Rule | Yes | Yes | No |

Test Accounts

Test accounts are akin to a trial period for a PRO account, allowing TakeProfitTrader to evaluate your trading skills. When you join the firm, these accounts will be displayed as the default option. To access your Test accounts and see how they’re performing, visit the Control Centre and click on an account to display its trading dashboard.

PRO Accounts

Traders who successfully complete a trading test qualify for a TakeProfitTrader PRO account, from which they can derive real income. There is a PRO account tab at the top of the TakeProfitTrader website, which enables you to easily switch between your Test and PRO accounts. Each PRO account can be reset three times, making the process more convenient by removing the need to take the test repeatedly.

PRO+ Accounts

PRO+ accounts offer advanced benefits for successful traders, including the elimination of daily loss limits and exemption from the 50 executions rule. This account type provides maximum flexibility for experienced traders who have demonstrated consistent profitability.

TakeProfitTrader Account Sizes and Pricing

TakeProfitTrader provides a variety of account sizes in line with the offerings of other futures trading funded programs. Monthly subscription fees start at $150 and go up to $360 based on account size, which spans from $25,000 to $150,000. PRO Accounts allow for up to three resets and entail a one-off fee, eliminating the requirement for recurring payments.

| Account Size | Max Contracts | Profit Target | Monthly Fee |

| $25,000 | 3 contracts | $1,500 | $150 |

| $50,000 | 6 contracts | $3,000 | $200 |

| $75,000 | 9 contracts | $4,500 | $250 |

| $100,000 | 12 contracts | $6,000 | $300 |

| $150,000 | 15 contracts | $9,000 | $360 |

TakeProfitTrader Risk Management Rules

Managing risk effectively is a fundamental part of trading profitably. TakeProfitTrader has established clear risk management rules that traders must follow to maintain their funded accounts. Understanding these rules is crucial for long-term success with the platform.

Daily Loss Limit

TakeProfitTrader has set fair daily loss caps that encourage traders to trade responsibly. These limits vary by account size and are designed to protect both the trader and the firm from excessive losses in a single trading day.

| Account Size | Daily Loss Limit |

| $25,000 | $750 |

| $50,000 | $1,500 |

| $75,000 | $2,250 |

| $100,000 | $3,000 |

| $150,000 | $4,500 |

Maximum Trailing Drawdown

One oversight in risk management that arises commonly is neglect of the EOD trailing drawdown. TakeProfitTrader has streamlined this rule for Test accounts, so that it is calculated at the end of each trading day rather than during the course of individual trades.

The mechanism is known as “trailing” because the minimum account balance “trails” the account balance as it increases. For example, if you earn $1,000 on your first trading day with a $25,000 account, your balance will rise to $26,000 while your minimum account balance adjusts to $24,500. The minimum account balance will persistently “trail” $1,500 behind your highest EOD account balance.

Important: Breaching the minimum account balance will lead to your account being immediately liquidated. Always monitor your trailing drawdown to avoid unexpected account closure.

Trading Instruments Available with TakeProfitTrader

TakeProfitTrader offers a diverse range of futures trading instruments, giving traders flexibility to apply their strategies across multiple markets. The instruments you can trade with TakeProfitTrader include:

Agricultural Futures

- Corn

- Wheat

- Soybeans

- Coffee

- Sugar

Energy Futures

- Crude Oil

- Natural Gas

- Heating Oil

- RBOB Gasoline

Metals Futures

- Gold

- Silver

- Copper

- Platinum

Equity Futures

- E-mini S&P 500

- E-mini Nasdaq

- E-mini Dow

- E-mini Russell 2000

Interest Rate Futures

- Treasury Bonds

- Treasury Notes

- Eurodollar

- Fed Funds

Foreign Exchange Futures

- Euro FX

- Japanese Yen

- British Pound

- Canadian Dollar

- Australian Dollar

TakeProfitTrader Trading Platforms

TakeProfitTrader provides traders with a choice of over 30 different trading platforms, giving them the flexibility to find one that best suits their needs. For data feeds, the prop firm generally recommends using the CQG Data Feed over the Rithmic Data Feed.

CQG Data Feed Platforms

- NinjaTrader – Popular for advanced charting and automated trading

- TradingView – Web-based platform with social trading features

- Tradovate – Cloud-based platform with modern interface

Rithmic Data Feed Platforms

- R-Trader – Direct platform from Rithmic

- Quantower – Modular platform with customizable workspace

- Bookmap – Specialized for order flow analysis

- Sierra Chart – Advanced charting and trading software

- Jigsaw Trading – Order flow trading specialist

The range of platforms on offer means there is one to cater to every trading strategy and goal, thereby ensuring that all traders partnering with TakeProfitTrader can succeed in trading profitably. Each platform offers unique features and capabilities, allowing traders to choose based on their specific needs and preferences.

TakeProfitTrader Profit Sharing Model

TakeProfitTrader’s profit-sharing arrangement prioritizes the trader, with an impressive 90/10 split allowing traders to retain a substantial 90% of all profits they generate. The firm keeps a modest 10%, underscoring their dedication to putting their traders first.

This generous profit split is among the most competitive in the industry, making TakeProfitTrader an attractive option for traders looking to maximize their earnings. Combined with the ability to request withdrawals from day one of trading in a PRO account, this creates a highly favorable environment for profitable traders.

TakeProfitTrader Review 2025: Pros and Cons

- Payouts can be requested from the first day of trading in PRO accounts

- Immediate withdrawal process

- Attractive 90/10 profit split

- PRO account can be reset three times

- Wide selection of trading platforms offered

- Diverse range of futures instruments

- Plausible profit targets

- Regular trading competitions with prizes

- Not many educational materials provided

- Restrictions on holding positions overnight and during news events

- No free trial

Is TakeProfitTrader Legit? Trustpilot Reviews and Reputation

When evaluating trading firms, assessing their legitimacy is paramount. Based on available information, TakeProfitTrader appears to be a credible and reputable prop trading firm, with clearly set out practices and rules that should instill traders with confidence.

TakeProfitTrader has over 800 Trustpilot reviews, with an impressive average rating of 4.3 out of 5 stars. Feedback on the firm’s services is overwhelmingly positive, with praise for everything from customer service to prompt and reliable payouts.

“TakeProfitTrader has been the most reliable prop firm I’ve worked with. Their payout process is quick and hassle-free, and their platform integration is seamless. I’ve been trading with them for 6 months and have received all my profits without any issues.”

Although a small percentage of reviews are negative, these are consistently and promptly responded to by the firm, leading to almost all issues being resolved. This further underscores TakeProfitTrader’s commitment to the needs of their traders and their dedication to continuously improving their service.

TakeProfitTrader FAQs

Is TakeProfitTrader Regulated?

How does Simulation work (test and PRO accounts)? Where do my orders go?

Are PRO accounts SIM?

Are the profits I make in SIM paid in real money?

Can I trade multiple accounts simultaneously?

TakeProfitTrader Review 2025: Final Verdict

For traders looking to profit from the futures market, TakeProfitTrader provides an appealing opportunity. With its wide array of trading instruments and account size options catering to diverse trading capacities, the prop firm stands out as a first-rate choice. Despite its current focus solely on futures trading and the absence of features like automated trading and overnight position holding, the firm’s ongoing evolution and dedication to providing traders with immediate returns on their trading efforts set them apart from the competition.

TakeProfitTrader offers a comprehensive service and cutting-edge technology at a reasonable cost, making it a worthwhile consideration for traders with a solid strategy and prudent money management practices. All in all, TakeProfitTrader could be the ideal partner for traders looking to maximize profits while reducing risks.