TradeDay has emerged as one of the most trader-friendly futures prop firms in 2025, offering a streamlined one-phase evaluation process with no time limits. This comprehensive TradeDay prop firm review examines how their unique approach to funding traders, generous profit splits, and flexible trading conditions make them an excellent choice for both new and experienced traders looking to access significant trading capital without risking their own money.

TradeDay Prop Firm Overview: What Sets Them Apart

Founded in 2020 and based in Chicago, TradeDay has quickly established itself as a leading futures proprietary trading firm. Unlike many competitors that use complex multi-phase evaluations, TradeDay offers a straightforward path to funding with their single-step evaluation process.

Key TradeDay Advantages

- One-phase evaluation with no time limits

- Generous profit splits (up to 95% for loyal traders)

- Daily payouts with minimal restrictions

- Multiple trading platforms supported

- Comprehensive educational resources

Ready to Start Your Trading Journey?

Get 40% off your TradeDay evaluation using code TD40

TradeDay Evaluation Process Explained

TradeDay’s evaluation process stands out for its simplicity and trader-friendly approach. Unlike other prop firms that require multiple phases, TradeDay uses a single-step evaluation that focuses on demonstrating consistent profitability.

Choose Your Account Size

Select from $50K, $100K, or $150K account sizes based on your experience and trading goals.

Complete the Evaluation

Trade for a minimum of 7 days and reach your profit target while respecting drawdown limits.

Get Funded

Once approved, receive your funded account and start trading with TradeDay’s capital.

TradeDay Evaluation Rules

| Requirement | Details |

| Minimum Trading Days | 7 calendar days |

| Maximum Time Limit | None – take as long as you need |

| Profit Target | Varies by account size (e.g., $3,000 for $50K account) |

| Maximum Drawdown | Choose between Static, End of Day, or Intraday |

| Position Holding | No overnight positions allowed |

| News Trading | Not permitted during major economic releases |

TradeDay Account Options and Pricing

TradeDay offers three distinct account types to accommodate different trading styles: Static, End of Day, and Intraday. Each comes with different drawdown calculations and position size limits.

| Account Type | Account Size | Profit Target | Max Drawdown | Regular Price | Discounted Price (40% Off) |

| Static | $50K | $1,500 | $500 | $150 | $90 |

| Static | $100K | $2,500 | $750 | $250 | $150 |

| End of Day | $50K | $3,000 | $2,000 | $165 | $99 |

| Intraday | $50K | $3,000 | $2,000 | $125 | $75 |

Limited Time Offer – Expires June 30th, 2025!

Use code TD40 to get 40% off any TradeDay evaluation account

Understanding TradeDay Account Types

Static Accounts

Fixed maximum drawdown that doesn’t move with account balance growth. Ideal for traders who prefer stability and predictability in their risk parameters.

End of Day Accounts

Trailing maximum drawdown calculated from realized profits at market close (16:00 CT). Suited for traders who prefer longer holding periods during the day.

Intraday Accounts

Trailing maximum drawdown calculated from unrealized profits in real-time. Perfect for short-term traders who want their drawdown to adjust with intraday gains.

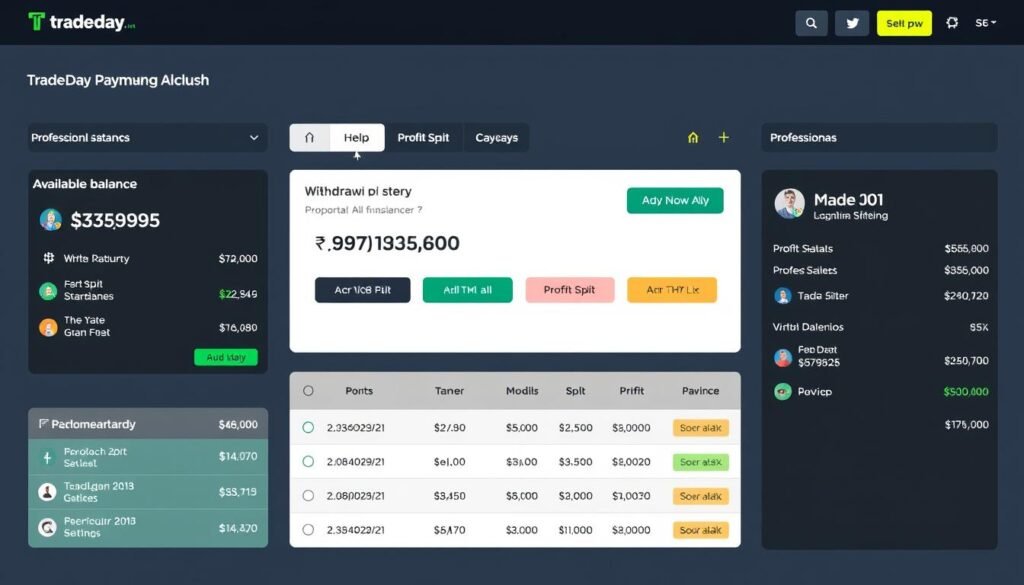

TradeDay Payout Structure and Profit Splits

One of TradeDay’s most attractive features is their generous and transparent payout structure. Unlike many prop firms that limit withdrawals or impose complex rules, TradeDay offers a straightforward profit-sharing model that rewards long-term traders.

TradeDay Profit Split Structure

- 80% on the first $50K of profits withdrawn

- 90% on profits withdrawn between $50K and $100K

- 95% on any profits withdrawn over $100K

Payout Rules

- Minimum payout request: $250

- Requests submitted before 5:30 PM processed same business day

- No restrictions on withdrawal frequency

- Buffer zone funds eligible for withdrawal (50% split)

“TradeDay’s profit split structure is one of the most generous in the industry, especially for traders who plan to stay with the firm long-term. The increasing percentage rewards loyalty and consistent performance.”

TradeDay Trading Platforms and Instruments

TradeDay provides access to multiple professional trading platforms, giving traders the flexibility to use their preferred tools and interfaces. All platforms connect to high-quality data feeds for reliable execution.

NinjaTrader

Professional-grade platform with advanced charting, automated trading capabilities, and extensive customization options.

Tradovate

Cloud-based platform with intuitive interface, low latency, and both desktop and mobile access for trading on the go.

TradingView

Popular web-based platform with powerful charting tools, social features, and Pine Script for custom indicators.

Available Trading Instruments

TradeDay specializes in futures trading, offering access to a wide range of CME Group products across multiple asset classes:

Equity Futures

- E-mini S&P 500 (ES)

- E-mini Nasdaq-100 (NQ)

- E-mini Dow Jones (YM)

- E-mini Russell 2000 (RTY)

- Micro E-mini versions of all indices

Foreign Exchange Futures

- Euro FX (6E)

- Japanese Yen (6J)

- British Pound (6B)

- Canadian Dollar (6C)

- Other major and minor pairs

Commodity Futures

- Crude Oil (CL)

- Natural Gas (NG)

- Gold (GC)

- Silver (SI)

- Agricultural products (Corn, Wheat, etc.)

Interest Rate Futures

- 10-Year Treasury Note (ZN)

- 30-Year Treasury Bond (ZB)

- 5-Year Treasury Note (ZF)

- 2-Year Treasury Note (ZT)

TradeDay vs. Competitors: How They Compare

To help you make an informed decision, we’ve compared TradeDay with two other popular futures prop firms: Topstep and Apex Trader Funding.

| Feature | TradeDay | Topstep | Apex Trader |

| Evaluation Phases | Single phase | Two phases | Two phases |

| Time Limits | None | 30 days per phase | None |

| Profit Split | 80-95% (tiered) | 80% | 80% |

| Payout Frequency | Daily | Weekly | Weekly |

| Overnight Holding | Not allowed | Limited | Allowed |

| News Trading | Not allowed | Not allowed | Allowed |

| Scaling Opportunities | Yes | Yes | Yes |

TradeDay Advantages

- Simpler one-phase evaluation process

- No time limits to complete evaluation

- Higher potential profit split (up to 95%)

- Daily payout processing

- Free resets with subscription renewals

- Comprehensive educational resources

TradeDay Limitations

- No overnight position holding

- Restricted news trading

- Futures only (no forex or stocks)

- Buffer zone funds subject to 50% split

TradeDay Trader Testimonials and Reviews

TradeDay has earned a strong reputation among traders, with a 4.6/5 rating on Trustpilot based on over 800 reviews. Here’s what funded traders are saying about their experience:

“I’ve tried several prop firms, and TradeDay stands out for their straightforward evaluation process and fast payouts. I was funded within two weeks and received my first profit withdrawal the day after requesting it.”

“The no time limit on evaluations was a game-changer for me. I could take my time, trade carefully, and pass without feeling rushed. Their support team is also incredibly responsive and helpful.”

“What impressed me most about TradeDay is their tiered profit split structure. As a long-term trader, seeing my split increase to 95% after consistent performance is a huge motivation to stay with them.”

Frequently Asked Questions About TradeDay

Is TradeDay a legitimate prop firm?

Yes, TradeDay is a legitimate proprietary trading firm established in 2020 and based in Chicago, USA. They have a strong reputation in the industry with over 800 positive reviews on Trustpilot and a transparent business model that focuses on trader success.

How long does it take to get funded with TradeDay?

The time to get funded varies depending on your trading performance. Since TradeDay requires a minimum of 7 trading days during evaluation, the fastest you can get funded is just over a week. However, there’s no maximum time limit, so you can take as long as needed to reach your profit target while respecting drawdown limits.

What’s the difference between TradeDay and Apex Trader Funding?

The main differences are: 1) TradeDay uses a single-phase evaluation while Apex has two phases, 2) TradeDay offers a tiered profit split up to 95% while Apex caps at 80%, 3) TradeDay doesn’t allow overnight positions while Apex does, and 4) TradeDay processes payouts daily while Apex does so weekly. TradeDay is generally better for day traders who want a simpler evaluation process and faster payouts.

Does TradeDay allow algorithmic trading?

Yes, TradeDay allows algorithmic trading and automated systems. You can use algorithms and bots on their supported platforms, including NinjaTrader, Tradovate, TradingView, and Jigsaw.

How does TradeDay’s profit split work?

TradeDay offers a tiered profit split structure that rewards long-term traders: 80% on the first K of profits withdrawn, 90% on profits between K and 0K, and 95% on any profits over 0K. This increasing percentage incentivizes traders to stay with the firm and consistently perform well.

Can I reset my TradeDay evaluation if I fail?

Yes, you can reset and repeat evaluations as many times as needed. TradeDay offers free resets when you renew your subscription, or you can pay a reset fee to try again immediately after failing.

TradeDay Prop Firm Review: Final Verdict

After thoroughly examining TradeDay’s offerings, it’s clear why they’ve become one of the top futures prop firms in 2025. Their streamlined one-phase evaluation process, generous profit splits, and trader-friendly policies make them an excellent choice for both new and experienced futures traders.

Who Should Choose TradeDay?

- Day traders who don’t need overnight position holding

- Traders who prefer a simple, straightforward evaluation

- Those who value fast, frequent payouts

- Traders looking for long-term scaling opportunities

- Anyone who appreciates comprehensive educational resources

Who Might Look Elsewhere?

- Swing traders who need to hold positions overnight

- Traders who specifically want to trade during major news events

- Those looking for forex or stock trading opportunities

- Traders who need more than 30 contracts per position

Ready to Start Your Funded Trading Journey?

Join TradeDay today and get 40% off your evaluation with code TD40

Limited Time Offer Expires June 30th, 2025